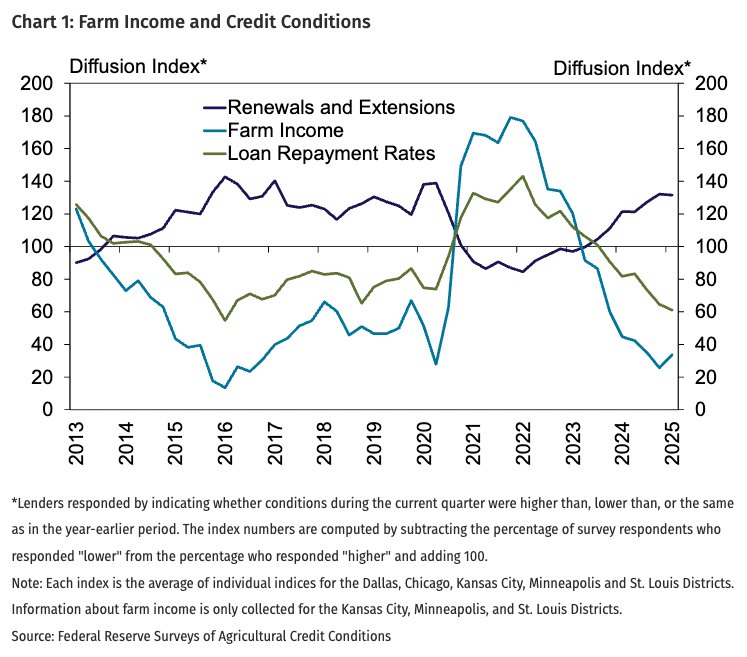

Agricultural credit conditions deteriorated in the first quarter of 2025 and farm real estate values softened in some regions, according to the Federal Reserve Surveys of Agricultural Credit Conditions. Weak crop prices over the past year contributed to lower farm incomes, a decrease in loan repayment rates, and an increase in renewals and extensions. Tighter farm finances also led to growth in loan demand and lenders reported steady increases in collateral requirements. Interest rates on agricultural loans declined slightly but remained relatively high and farm real estate markets continued to cool in most regions.

Agricultural credit conditions weakened during the first quarter alongside gradual deterioration in a variety of farm financial metrics. Loan renewals and extensions, on average, increased at a pace similar to recent quarters and farm loan repayment rates declined at a faster pace across all districts (Chart 1). Indicators of credit conditions weakened as the share of respondents reporting farm incomes lower than a year prior remained similar to last quarter.

Screen Shot 2025-06-09 at 11.07.10 AM

Demand for farm loans also continued to grow as farm finances tightened, but credit availability was steady. Demand for non-real estate loans, on average across all districts, increased at the fastest pace since 2016 (Chart 2). As demand for farm loans continued to grow, availability of funds among agricultural lenders remained unchanged following gradual declines throughout 2024.

Screen Shot 2025-06-09 at 11.07.21 AM

As credit conditions weakened and demand for loans increased, more lenders reported tighter credit standards. The share of respondents that reported an increase in collateral requirements compared with a year ago was the highest in over a decade across all districts (Chart 3). The most notable increase in collateral requirements was reported in the St. Louis District, where farm finances for the quarter were weaker than in other regions.

Screen Shot 2025-06-09 at 11.07.30 AM

Farm loan interest rates continued to decrease from highs reached in 2023 and 2024. On average across all districts, rates on both operating and real estate loans were about 60 basis points less than a year ago (Chart 4). Farm loan interest rates have declined over the past year alongside lower benchmark rates; however, they remained elevated relative to recent historical averages.

Screen Shot 2025-06-09 at 11.13.59 AM

Agricultural real estate valuations remained strong, but land markets softened in many areas alongside weaker farm finances and relatively high interest rates. Nonirrigated cropland values increased by less than 5% from the previous year in the Chicago and Minneapolis Districts and decreased slightly in the Kansas City District (Chart 5). Values in the Dallas District increased notably, with local contacts continuing to report strong recreational and investor demand.

Screen Shot 2025-06-09 at 11.08.04 AM

More Like This, Tap A Topic news