Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

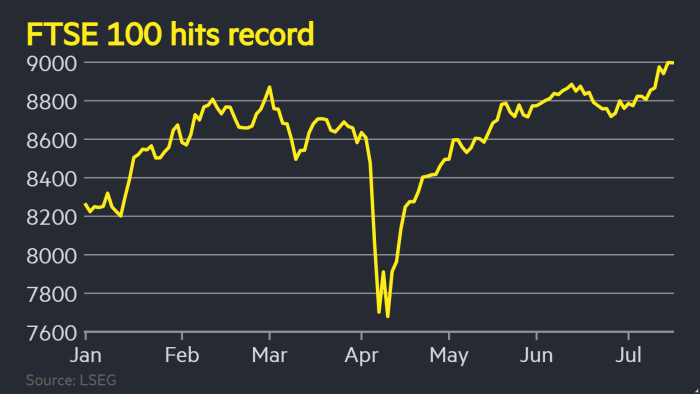

The FTSE 100 has reached 9,000 points for the first time, as UK stocks benefit from global investors diversifying away from the US amid uncertainty over President Donald Trump’s trade war.

The UK blue-chip stock index has outperformed the S&P 500 and the Stoxx Europe 600 indices so far this year, having climbed 10.3 per cent.

UK stocks have benefited this year from greater investor interest in non-US assets, a trend prompted by concern about Trump’s volatile policymaking.

“It’s a good place to hide,” said Emmanuel Cau, head of European equity strategy at Barclays.

The UK reached a partial trade agreement with the US in early May, which some analysts say has given the London market an advantage over its European peers.

“As long as we have this tariff overhang, the FTSE 100 should be doing well . . . compared to indices on the continent being capped by tariff uncertainty and euro strength,” Cau said.

Low valuations of London-listed stocks have also attracted those looking for different places to invest this year.

The FTSE 100 trades at a price-to-earnings ratio of about 17 times, compared with 27.3 for the S&P 500, according to LSEG data.

“People are freaked out about Europe with the tariffs, so the UK is almost a ‘safe haven’ from a valuation perspective,” said Neil Birrell, chief investment officer at UK investor Premier Miton, adding that the UK’s trade agreement “gives a degree of comfort to investors”.

Cau said the FTSE 100 was “largely benefiting from strength in a few big sectors”, including mining, telecoms, financials and utilities.

Defence stocks have been some of London’s top performers so far this year. Shares in BAE Systems have risen about 65 per cent since the start of the year, while Rolls-Royce has climbed 75 per cent.

Financial companies have also boosted the index after a strong start to the year. Shares in Lloyds Bank are up about 41 per cent and Prudential has increased about 47 per cent.

However, investors said the UK government’s tight fiscal position remains a barrier to further growth.

“I will struggle with the UK until we’ve got some more certainty on the fiscal position,” said Birrell.

Barclays’ Cau said “if we see a proper bond market strop” about the UK’s fiscal position, then “there might be a ‘sell UK’ moment”.

Additional reporting by Ray Douglas