Note: Agricultural banks are defined as banks with total agricultural loans comprising at least 25% of total loans. Figures above are calculated using the same group of 941 agricultural banks from Q1 2025 in every quarter.

Sources: Reports of Condition and Income and Federal Reserve Board of Governors

Finance-RFP-071425

Growth in farm debt at commercial agricultural banks remained elevated in the first quarter of 2025 and loan delinquency rates increased modestly. According to Reports of Condition and Income, outstanding agricultural loan balances at commercial banks increased 3% from a year ago. At agricultural banks, the increase was almost 7%, boosted by considerable growth in production loans and moderate growth in farmland loans. Farm loan delinquency rates remained historically low but increased slightly for the second consecutive year. Despite modest deterioration in credit conditions, earnings and capital performance at agricultural banks remained sound.

Demand for financing has grown alongside elevated production costs and reduced working capital for many producers. Liquidity at agricultural banks was relatively stable in aggregate and continued to support credit availability, but the share of lenders with tight liquidity positions increased gradually in the first quarter. The outlook for the agricultural economy remained subdued as crop prices remained relatively weak and will likely continue weighing on farm finances and credit conditions in the coming months.

FIRST QUARTER

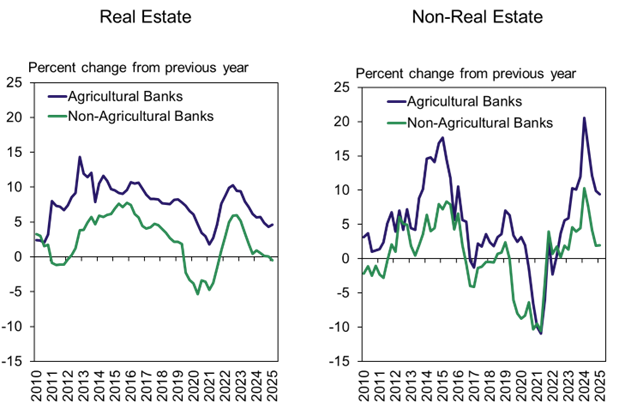

Farm debt at agricultural banks continued to grow swiftly in the first quarter of 2025. According to commercial bank call reports, real estate and non-real estate farm debt at agricultural banks grew about 5% and 9% from a year ago, respectively (Chart 1). At non-agricultural banks, growth in outstanding production loan balances was less pronounced relative to agricultural banks and farm real estate debt was nearly unchanged.

Note: Agricultural banks are defined as banks with total agricultural loans comprising at least 25% of total loans. Figures above are calculated using the same group of 941 agricultural banks from Q1 2025 in every quarter.

Sources: Reports of Condition and Income and Federal Reserve Board of Governors

Finance-RFP-071425

Growth in farm debt was more pronounced among banks with higher concentrations of agricultural lending. Total farm debt increased by more than 8% from last year among agricultural banks with a concentration of farm loans greater than 300% of capital (Chart 2). The rate of growth was slightly lower for banks with moderate concentration and was almost half as much at lenders with less than a 200% concentration of agricultural loans.

*Ag Loans as a % of Tier 1 Capital + Allowance for Loan Losses.

Note: Agricultural Banks are defined as banks with total agricultural loans comprising at least 25% of total loans.

Source: Reports of Condition and Income and Federal Reserve Board of GovernorsFinance2-RFP-071425

The increase in outstanding farm loan balances was also slightly more pronounced at small and mid-sized agricultural banks. Total farm debt increased by more than 6% from last year among agricultural banks with farm loan portfolios less than $500 million (Chart 3). While the rate of growth was only slightly lower for lenders with the largest portfolios, the smaller portfolios accounted for the majority of additional outstanding balances at agricultural banks.

Note: Agricultural Banks are defined as banks with total agricultural loans comprising at least 25% of total loans.

Source: Reports of Condition and Income and Federal Reserve Board of GovernorsFinance3-RFP-071425

LIQUIDITY TIGHT

Alongside strong loan growth, liquidity was notably tight for a growing share of farm lenders. The aggregated loan-to-deposit ratio across agricultural banks declined in the first quarter of 2025 relative to 2024 but remained close to the 20-year average (Chart 4). About two thirds of agricultural lenders continued to report loan-to-deposit ratios less than 80%, but the share with ratios above 80% increased relative to a year ago.

Note: Agricultural Banks are defined as banks with total agricultural loans comprising at least 25% of total loans.

Source: Reports of Condition and Income and Federal Reserve Board of GovernorsFinance4-RFP-071425

Following gradual deterioration in farm financial conditions over the past year, delinquency rates edged higher. At agricultural banks, delinquency rates for both farmland and production loans increased modestly in the first quarter of 2025 (Chart 5). For non-agricultural banks, the delinquency rate on real estate loans increased modestly and leveled off for non-real estate loans.

Note: Delinquent farm loans include all agricultural loans past due 30 or more days or non-accruing. Agricultural banks include all banks with farm loans comprising at least 25% of total loans.

Sources: Reports of Condition and Income and Federal Reserve Board of GovernorsFinancer5-RFP-071425

Despite signs of modest deterioration in credit conditions, financial performance at agricultural banks remained sound. The net interest margin, return on average assets and Tier 1 leverage capital ratio at agricultural banks all increased relative to last year (Chart 6). Interest margins remained below the longer-term average, but strong overall returns pushed the Tier 1 leverage capital ratio well above the average.

*This capital ratio excludes unrealized gains (losses) and is not reported in Ag Finance Update tables.

Note: Agricultural banks are defined as banks with total agricultural loans comprising at least 25% of total loans. Figures in the right panel are calculated using the same group of 941 agricultural banks from Q1 2025 in every quarter.

Sources: Reports of Condition and Income and Federal Reserve Board of GovernorsFinance6-RFP-071425

More Like This, Tap A Topic news